KAZERA GLOBAL – FOR ONE NIGHT ONLY!

A cursory glance at this blog page will reveal that we have been inactive for nearly 2 years now. Our business evolved into a debt & mezannine finance offering through our sister company Catalyse Capital Ltd.

Housed within Catalyse and my own personal holdings are a number of major investments in the UK small cap arena facilitated through both equity and debt. Kazera Global Plc is one of our largest holdings and we remain the largest shareholder (following an aborted sale to Africa Mineral Sands and its “straw man” Mr Premraj Caralapati Raghairah).

To say that the last 5 years have not been without its challenges for Kazera Global is an understatement. From ejecting previous underperforming management Giles “Cry Baby” Clarke & Larry Johnson, to local difficulties at the mine and of course the madness of Covid that curtailed activities globally, it is clear that doing business in Africa is not easy. The small cap arena is littered with hundreds upon hundreds of mining minnows in many a far flung jurisdiction that have basically been dilute machines for long suffering shareholders and, in inexcusable contrast, management enriching exercises. Kazera is a veritable “needle in a haystack” that has not displayed these characteristics.

Since I got involved with the Co through vending the diamond and HMS operations in in early summer 2020, the share count has been contained through opportunistic placements and debt facilitation on amenable terms – in fact we have only gone from just under 700m shares 5 yrs ago to just under 1bn today – contrast that with Ironveld for example where the share count has expanded from less than Kazera at the time to near 14bn!!!!. Of course the sale of TVM to Hebei and the initial @ $4m cash received from that sale in late 22/early 2023 allowed for the build out of our now key SA HMS operations has had the beneficial effect of containing equity issuance too and was a master stroke by CEO Dennis Edmonds (who is also one of the most modestly paid CEOs on AIM and has refrained from taking any salary increase for over 3 years as we attempted to “right side” the business).

The events of the last 6 months have been truly seismic for the Co. From, in July, my realizing that “Prem” Premraj was a straw man that could not follow through on his promises and so taking back the 29.9% stake and then providing the funding with Tracarta for the all-important purchase of the 10% interest in both Deep Blue Minerals & Wale Head Minerals from Tectonic Gold (with the @ £45m of loan repayment entitlement from the BEE partners) and so avoiding an equity raise at a bonkers low level, to the bringing on board of now Non Exec Chairman Dr John Wardle – a seasoned, honorable and extremely high calibre individual. Each of these were material events in their own right but, the newsflow that has really changed the landscape for shareholders, was the go ahead by the National Nuclear Regulator in August to allow for the initial mining commencement on the 5ha parcel in Alexander Bay and then early notification of the last stages of the Perdevlei licence award (see below the import of this and scale of it) – a 17km stretch of beach with @ £1bn of NPV (at a 20% disc rate!) of resource.

The remaining piece of the jigsaw was the key offtake (sale of product) agreement which management unveiled as an early Xmas present on Fri per here – https://www.investegate.co.uk/announcement/rns/kazera-global–kzg/heavy-minerals-sands-offtake-agreement/8608448

Fujax are a serious partner and this initial 100k tonnes sale agreement will both prove concept and generate meaningful cashflows. From there, with Perdevlei hopefully confirmed ref its award to the Co in Jan 2025, the upside for Kazera (and shareholders thereof) is truly massive. See below the research produced recently in relation to the existing 5ha licence and flow through economics and the much larger licence area.

At the close on 13 Dec 2024 the market cap of Kazera was @ £15m. The thick end of £8m is owed to Kazera by Hebei (and they DO have the assets and means to pay from what we have ascertained), meaning that the SA operations are valued at @ £7m. With the hoped for imminent award in early 2025 of the key Perdevlei licence that, we repeat. has an NPV of approaching £1bn, to say that this is an undervaluation is probably the understatement of the year.

Unlike many other resources, Heavy Mineral Sands are very easy to process. It is literally a “lift” of the product from the beach then process through the DMS plant (and or a magnetic separator to split out even higher value constituents from the sands) and sell the end product (which is used in many every day materials including paint). The costs of mining this £1bn resource are a fraction of the NPV, again unlike almost every other resource (gold for example is very capex intensive and “yield to effort” low). Not only this, but given the prodigious cash flow profile of the project, then for Kazera the upgrading or running of multiple processing plants can be purchased from internal cash flows. What does this mean? NO EQUITY DILUTION.

We are hard pressed to observe any other UK listed small cap that has, from a seed of an idea just under 5 yrs ago gotten to the point where they are in production, with minimal equity dilution along the way, and are now about to reap very serious cash flows. Kazera could very well be a dividend paying stock within 12 months and based on management’s projections of the cash flows just from the 5Ha licence less the corporate overhead, with a 50% payout ratio the stock, at the current price, could be yielding approaching 20% on a proforma basis. And this EXCLUDES any receipt from the Hebei balance debt that we will push for a special divi or share buy back.

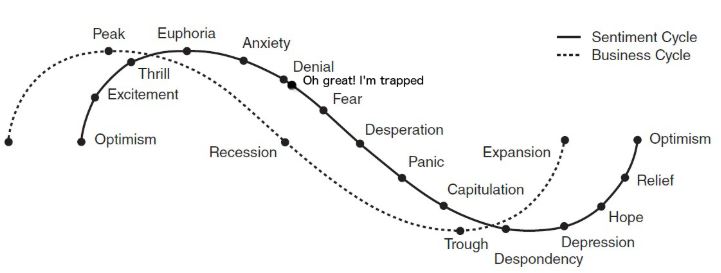

One gauge that I always use to check where we are at any point in a stock price’s journey is the Investor Sentiment Cycle chart (see below). I find it near infallible and it is clear to me that we are likely at the “Hope” stage and this is borne out in the long term 10 year chart (see below also) and which tells its own technical picture.

To conclude, Kazera offers a business today through their SA operations that, henceforth 24 months from now, could be trading at a shade under 2 times PE, that has an 80+ years life of mine, the very real prospect of a sustainable and growing dividend from continuing operations, no equity dilution on horizon, and enjoys both my & Tracarta’s support. Directors buying on market in recent months signals overtly their view of the stock’s undervaluation too. Finally, to add the icing on the cake, throw into the mix the potential of a special divi/share buyback in 2025 if the Hebei arbitration goes the way we expect.

As we said at the beginning of this piece – “for one night only”. This really will be our last piece and given the many non-performing and some quite frankly fraudulent companies that we have witnessed in the small cap arena over the last 8 years, Kazera really seems to us to be the, excuse the pun, “jewel glistening in the sand”. We wholeheartedly believe that this company will finally prove its worth in 2025 and potentially offer life changing returns to early investors.

RISK WARNING & DISCLAIMER

Align Research’s director and related parties including Catalyse Capital Ltd are the largest combined shareholders in Kazera Global and as such cannot be seen to be impartial in relation to the outcome of the Company’s share price. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk. You should also assume, given that the majority of Align’s fees are received in stock, that for general corporate cash management purposes including taxation, that divestments of investments held will take place as and when, in Align’s sole discretion, it is deemed appropriate.

This financial promotion has been approved by Align Research Limited