Corcel – farm-out and joint venture agreement with Riversgold for REE project at Mt. Weld continues to re-form Company

By Dr. Michael Green

Looks like things are moving rapidly at Mt. Weld for Corcel, the natural resources exploration and development company with primary interests in battery metals. It was only a month ago that the company exercised its option here and this morning we have had news of a cracking deal that will see rapid exploration at no cost to Corcel.

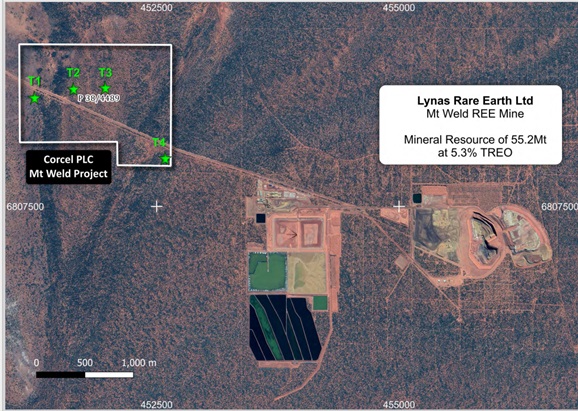

In early December 2022, Corcel exercised its option to a 100% interest in the Mt Weld (P38/4489) Project. This is a granted mineral tenement which lies less than a mile away from Lynas Rare Earths’ (ASX: LYC) Mt. Weld REE Mine near Laverton in Western Australia. The project is 171 hectares in size where the underlying geology is obscured under recently transported sediments. T1, T2, T3 and T4 (shown in the map below) represent four discrete undrilled magnetite features, potentially representing carbonatite intrusive complexes, which would make for good immediate drill targets.

Corcel’s Mt Weld Project lies in very close proximity to Lynas Rare Earth’s Mt Weld REE Mine.

Source: Company

This morning the City learnt that Corcel had entered into a farm-out and joint venture agreement with Riversgold (ASX:RGL) covering its recently acquired rare earth elements (REEs) project at Mt. Weld. This deal will see A$30,000 cash immediately paid to Corcel, with RGL able to earn a 50% interest in the project through paying 100% of the work programme, spending A$500,000 over a 12-month period.

In addition, Corcel has the right, but not the obligation, to allow the farm-in of a further 20% for an additional A$1,000,000 carry on the work programme, bringing total carried expenditure to A$1,500,000. RGL will operate the tenements and direct the exploration programme on behalf of the company.

Chief Executive Officer, Scott Kaintz commented that “We are delighted to follow directly our acquisition of Mt. Weld with a farm out of half of the position to fund 100% of the near-term development and exploration costs. This is highly accretive against our acquisition cost and further reinforces the Board’s view of the project’s immediate potential upside and overall attractiveness. Our partner, Riversgold Ltd, brings with them an experienced exploration team well positioned to lead the work on the ground in Australia. We look forward to working with them in 2023 to take the project forward.”

Riversgold is an ASX-listed exploration company focused on discovering and developing large lithium systems in the world-renowned Pilbara and Yilgarn cratons of Western Australia. RGL has a market cap of some £12 million and at the helm is the well-known small cap resources champion David Lenigas who is the Executive Chairman. It looks as though RGL has been moving rapidly to snap up some areas which have good potential to host a major lithium-caesium-tantalum system. In addition, the Riversgold portfolio also offers strong exposure to gold and nickel through its large landholding at the Kurnalpi Project in the Yilgar, to which they now seem to be looking to add REEs.

Riversgold recently raised money for its lithium projects and for some reason can’t work on them straight away. So, they have funds and an exploration team kicking their heels. Corcel’s Mt. Weld obviously has attractions in being available to drill immediately, with big upside potential and an obvious exit with Lynas next door.

Corcel had planned to do a cheap and cheerful drilling programme of the highly attractive targets in early 2023. The parallel ASX announcement from Riversgold mentions that with the rare earth global markets very strong at present and the tenement already being granted, their team aim to be drilling Mt Weld this quarter. It also looks like there are further REE opportunities Down Under where Corcel might look to get involved.

Corcel has recently attracted the attention of some really serious players in the battery metals world, and this is arguably the biggest story in the history of the company. In mid-October 2022, investors got the first sniff that Corcel was reorganising its battery metal mining interests in Papua New Guinea. Offtake discussions on the nickel (from interests with Shandong New Powder COSMO AM&T (NPC)) have morphed into the formation of a new joint venture company with Corcel called Integrated Battery Metals (IBM). This has been formed in Singapore to hold CRCL’s positions in the Mambare (41%) and Wowo Gap (100%) projects alongside the Doncella lithium project in Argentina.

This is being established in order to pursue an Asia focused battery metals strategy with direct links to offtake partners and end users of these critical battery metals. The big players behind NPC are beginning to see Corcel as their vehicle for development opportunities and so were happy to invest in recent weeks at a 95% premium to the share price. AIM companies rarely attract these kinds of backers and so, in our opinion, we believe it is time for the market to begin to reappraise the company’s prospects going forward.

The move away from flexible energy generation, leaves Corcel continuing its search to develop a cash generative arm. The focus now seems to be developing a revenue stream based on the sort of technologies that its new big battery metal partners in Asia have at their disposal. These partners broadly give the company access to battery recycling technology as Corcel now has a partnership with two large cathode producers. The possible future venture might be involved in say recycling batteries or even recycling the waste from the production of batteries and electronics. We see this as a really tremendous opportunity that wasn’t there a couple of months ago.

At the current price of 0.27p, Corcel is capped at just over £2 million on an enlarged share count basis. With the debt the company was carrying almost halved, then the Enterprise Value of @ £3m we believe does not reflect the major change of strategy over the last several months. It looks as though Corcel Mark II is now deep in the midst of becoming fully formed as in the background the formal closure of the restructuring process is going on. Coming weeks ought to see the further delineation of the revised strategy. All of this should really help outline the company’s serious Asian connections and the strength of its new partners.

The transformation of the business strategy means that our previous target price is clearly no longer valid. We look forward to updating our coverage on the stock and reassessing the value of the various elements that now make up Corcel in the near term. Ahead of that analysis, we instinctively realise that given such an attractive mix of impressive components in a number of hot sectors, that the company deserves far better than to trade at a de facto shell company type of valuation. We remain holders and supportive shareholders and expect to see a major re-rating in 2023.

RISK WARNING & DISCLAIMER

Corcel is a research client of Align Research. Align Research’s Director and related parties are collectively the second largest holders in the shares of CRCL and also hold a large volume of warrants over the company and so cannot be seen to be impartial in relation to the share price outcome. All employees and analysts are bound to the company’s dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk. You should also assume, given that the majority of Align’s fees are received in stock, that for general corporate cash management purposes including taxation, that divestments of investments held will take place as and when, in Align’s sole discretion, it is deemed appropriate.

This financial promotion has been approved by Align Research Limited