Red Rock Resources SOTP valuation increase post Steelmin news

There was good news this morning from Red Rock Resources in an update on Steelmin Limited in which it was revealed that is restarting a ferrosillicon and silicon metal smelter complex in Bosnia, funded by a back-to-back finance deal through Red Rock. Apparently, Steelmin has signed a Structuring and Placing Agreement with a Luxembourg investment vehicle under which Steelmin intends to repay the full amounts outstanding to Red Rock.

Steelmin forecasts first production in March 2018, following the completion of the refurbishment of the ferrosilicon complex. This looks like good timing as ferrosilicon prices are strengthening. Steelmin’s plant will initially consist of the refurbished Furnace V annually producing 29,000 tonnes of ferrosilicon and 5,800 tonnes of microsilica. That is planned to be followed by the refurbishment of a second furnace will have a combined annual capacity of 48,720 tonnes ferrosilicon (FeSi 75) and 9,700 tonnes of microsilica, although this stage of the project has still yet to be funded.

The end result is that Red Rock will be left with a net positive balance of some £1.8 million on the back to back facility after the repayment of all amounts due to and from the company. In addition, Red Rock will have a stake of 21-22% in Steelmin.

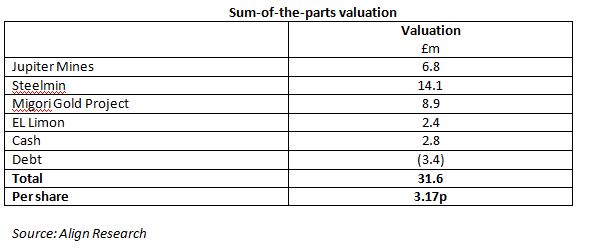

Adding this net positive balance of £1.8 million and a 21.5% (say) stake in Steelmin increases our sum-of-the-parts valuation to £31.6 million (against our previous valuation of £28.8 million) as detailed below. Based on the current number of shares in issue (499,042,740) we have a per share valuation of 6.33p (previously 5.77p). However, in applying our usual conservative approach we have used a fully diluted basis (995,285,845), giving a valuation that equates to 3.17p per share (previously 2.89p). At the current stock price of 0.95p the shares remain, in our opinion, a steal (excuse the pun!) and we would not be surprised post receipt of any funds from the Jupiter Mines float if the company announces a share buyback or special dividend. Buy.

DISCLOSURE & RISK WARNING

A Director of Align Research Ltd & the Company hold positions in Red Rock Resources and are bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”).

This is a marketing communication and cannot be considered independent research. Nothing in this report should be construed as advice, an offer, or the solicitation of an offer to buy or sell securities by us. As we have no knowledge of your individual situation and circumstances the investment(s) covered may not be suitable for you. You should not make any investment decision without consulting a fully qualified financial advisor.

Your capital is at risk by investing in securities and the income from them may fluctuate. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results. The marketability of some of the companies we cover is limited and you may have difficulty buying or selling in volume. Additionally, given the smaller capitalisation bias of our coverage, the companies we cover should be considered as high risk.

This financial promotion has been approved by Align Research Limited.