Valeant – the end game is upon us

By Richard Jennings CFA

Now is the optimum time for an industry player to make a bid

Possible return of Takeda Pharma of Japan

Levers likely to be pulled on crown jewel Bausch & Lomb

Forward debt profile looks manageable

Stock now trades at book value – almost unprecedented for pharma plays

Sentiment has the reached point of maximum pessimism as evidenced by analyst price forecasts

The reaction to last week’s 4Q results by Valeant Pharmaceuticals has confounded many of the longs. Although the company beat modestly on the top line and at the earnings level with the shares initially trading towards $17.5 in the pre market session, by the end of the day the price had once more followed the all too familiar pattern of delivering pain to long suffering bulls and closed sharply lower. By the end of last week the stock had in fact breached the 52 week low to print a new trade low of $12.90c and which, as of today’s date has also been sliced through, trading down towards, incredibly, lows of $11.

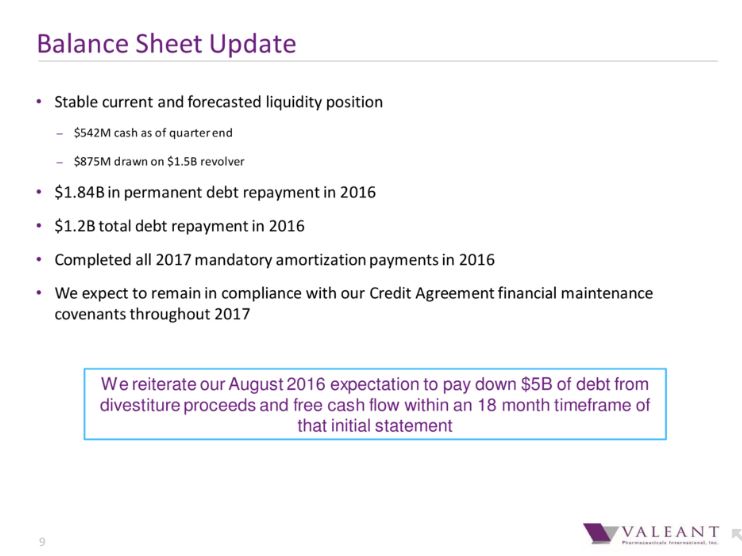

Analysis on the debt side has been done to death and there is little that I can add here to that argument and conjecture save for reproducing the slide below from Valeant itself:

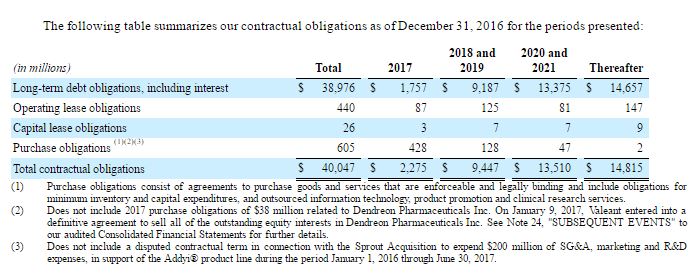

The highlighted language is pretty explicit re the words “reiteration, divestitures and free cash flow”. What that tells me, in unison with below from the 10K is that there is no potential liquidity issue until 2018 as we can see over $9bn of debt & LT obligations is then due for repayment.

If management are true to their statements re retiring $5bn of debt by early 2018 (and with last week’s closure of the sales of CeraVe, AcneFree And AMBI Skincare Brands To L’Oréal for $1.3bn it looks like they are some way already towards this figure), then the 2018 & 19 figures for debt repayment of a total of $9.18bn will likely not require a refinancing given forecasts of free cash flow of circa $1.4bn for 2017 and growing from this level through financial years 2018 & 2019.

If we thus start from the premise that there will be no debt issue or covenant breach this year, investors are looking at the following bald statistics:

At the today’s price of $11.56c, the current market capitalisation is now, amazingly, less than $4bn. With free cash flow forecasts of a base of $1.4bn for 2017 and rising thereafter, the stock must surely be on the radar of other industry players with less stressed balance sheets.

In the case of Allergan for example, their much higher valuation could allow them to pay 5-6 forecasts OpFCF which would equate to around $25-30 per share if this was done via a stock offer and be materially earnings enhancing for Allergan shareholders, quite aside from natural synergy benefits. At that price, absorbing VRX’s debt onto their balance sheet and re-financing or carrying out divestitures of Salix and other divisions would be, in the parlance, a “no brainer”. At $8-10bn as an equity takeout level, the cost is a mere morsel to Allergan.

If ever VRX was to be swallowed whole then I believe now is the most optimum moment for this and I would be highly surprised if the Street’s biggest investment banks were not running the numbers on consolidation scenarios with various players.

In the alternate, I also believe that Ackman and Paulson are now likely to press for the least dilutive financial engineering approach to catalyse a serious re-rating of the stock. The easiest and most effective way to do this is to create a “see through” valuation for Bausch & Lomb. I would not be surprised in the months ahead to see a spin-off of this division. Valuations range from $12bn – $20bn. B&L is seen as a true “durable” and growth segment of Valeant and my own conservative estimate of its worth is around $16bn which would be a circa 11 times EBITA multiple for 2017 and, it should be noted, a discount to the sector which trades on approx 16-17 times.

If VRX were to sell of 30% of this to generate an equity check receipt of $4.8bn whilst retaining the upside from the majority share and, simultaneously getting a true market valuation of this from the listing and possibly generating a full takeover, the balance sheet would be transformed. With some of VRX’s bonds trading towards 9% too, buying these back in the market would be a smart move and also generate a net income gain for VRX. In the parlance once more, this is also a total “no brainer”.

To conclude, the equity value has now fallen to such a level (marginally over book value which is almost without precedent in the specialty pharma sector) and sentiment is so depressed (as evidenced by analysts lowering price target to $10 in some cases) it is all but inevitable that there will be some type of catalyst in the near term to restore a vestige of true value. We call it here “asymmetric skew” and at $11.56 given the points made here re the debt profile and the likely attraction to industry players like Allergan (and a possible return of Takeda for the full entity not just Salix this time) the upside looks to be many multiples of the downside at this level. I’d go as far as to say it is one of the most attractive opportunities I have seen in the markets in my long career.

CLEAR DISCLOSURE – The author, who is a Director of Align Research Ltd, holds a personal position in VRX and is bound to Align Research’s company dealing policy ensuring open and adequate disclosure. Full details can be found on our website here (“Legals”)